Well That Was (Not) Fun

This Past Week: A Great Case Study

Annuity vs IRA

I found this question to be a bit weird, from the beginning.

An IRA is really about the fact that IRAs and 401ks are tax-deferred. You don’t pay tax, until you take a distribution, to your bank or brokerage account. You can buy or sell any holding within an IRA or 401k with no consequences.

An annuity is a holding, within an account. That account can be either a taxable or a tax-deferred account. The point is that an annuity, if you have one, would have a specific function within your suite of financial holdings. There are many different types of annuities. The common thread is that there are insurance-like features (like a death benefit) that exist, prior to the time that you convert to lifetime income. The amount of that lifetime income can and will vary based on the account value, unless there is a lifetime guaranteed income rider.1

Can an annuity be held in both taxable and tax-deferred accounts? Yes. In the past, there was a complication regarding the withdrawal from annuities that were held in tax-deferred accounts. That complication has been corrected, with the passage of the Secure Act 2.0.2

Summary

I have stated, and will stand by my statement: “Money has a naming problem.” I would much rather that people understand that different securities/policies/whatever may share similar-looking or similar-sounding names, but that the pattern of cash flows, under certain scenarios (higher stock markets, your requirement for a root canal being two very different situations), will be very different.

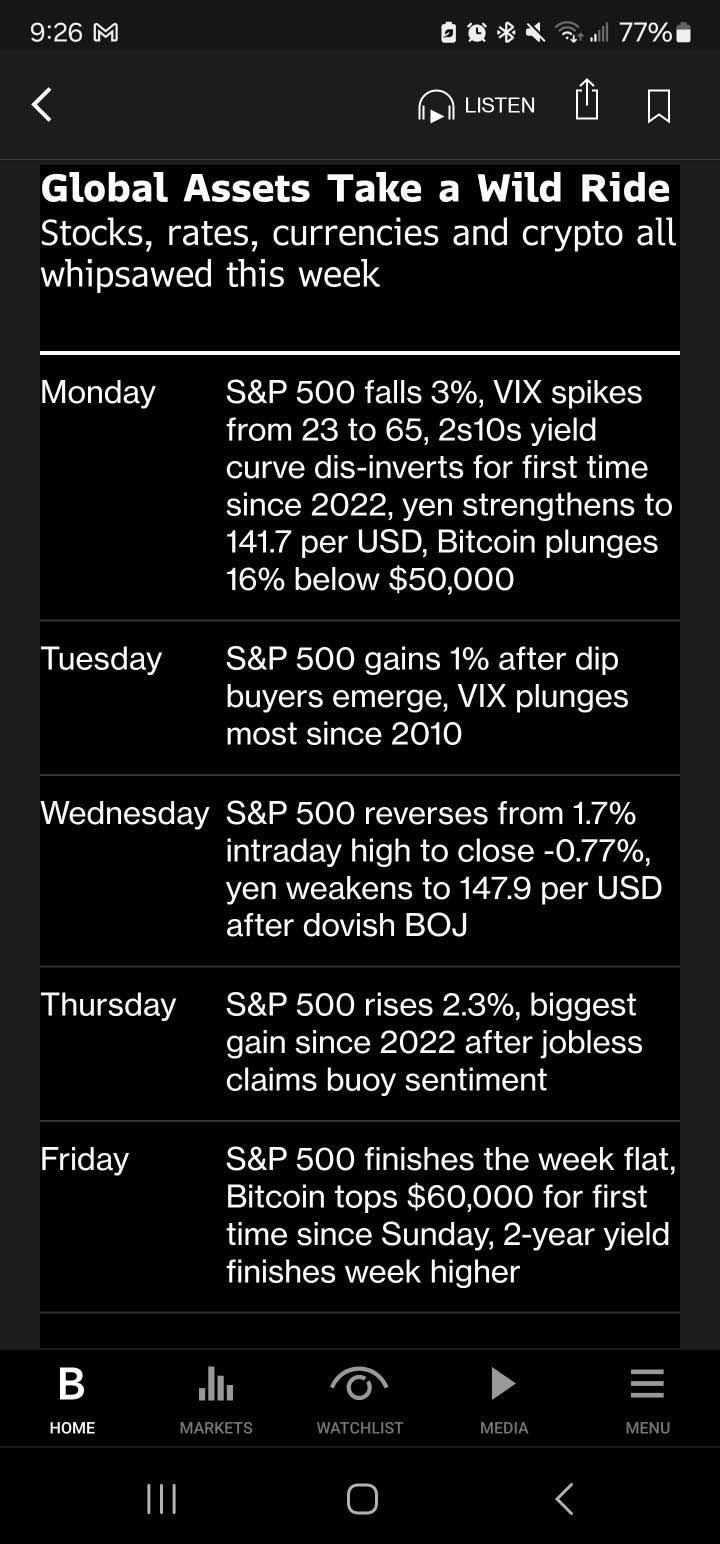

Mr. Market’s Wild Ride

Well, at least it’s not boring, I’ll give you that. Armchair investors learned a new phrase: Yen Carry Trade. This is not new.

Takeaways That Investors Can Remember

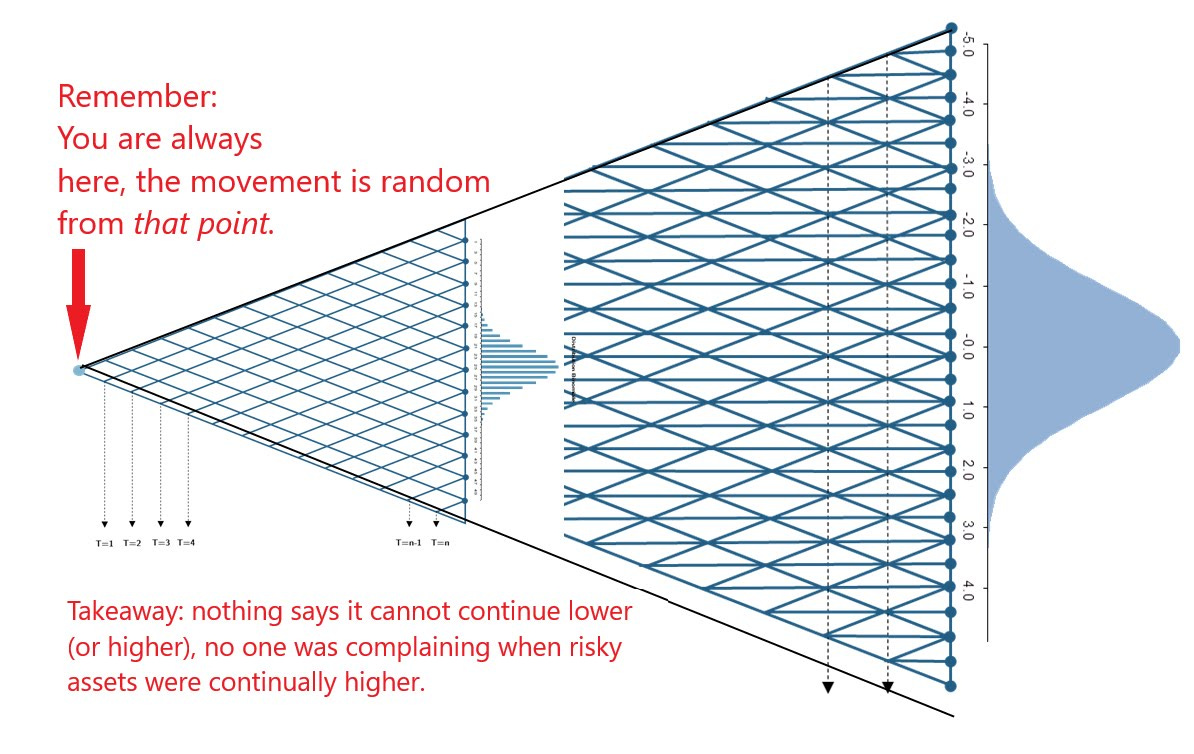

There was nothing to guarantee that the situation would’ve subsided, at all. If it did not subside, equities maybe down another 10%. And then you start again “Start Where You Are.”

If the market had continued to decline, then you get reminded of sequence risk.

Market volatility provides a “gut check.” For me, the time to pay attention is when markets are volatile in either direction. These periods help you to make sure that your sensitivity is what you believed it to be. You can make sure that it fits your household situation, just in case points #1 and #2 become reality. Again, risk/uncertainty are a normal part of life. Unintended risk/uncertainty is different, and should be avoided. If you want to swing for the fences, so be it, that is up to you.

If you are trying to “buy low,” remember that the success stories are full of bias, namely survivorship bias and availability bias.3 Remember: I don’t have a crystal ball, and neither do you. If we did, then we wouldn’t need a portfolio of diverse holdings.

While the world scurried in search of an explanation, and then an assessment of whether or not the Yen Carry Trade was a “thing,” I shared this video early Monday AM, before the week commenced. The point of this newsletter is that the retail market is not told about the complicated mechanics of global financial markets. Some of it will scare the bejeezus out of you. That said, it has also provided the path by which you have been able to buy the house of your dreams, so let’s be too quick in throwing rocks at others.

Maybe my reporting and hints of this latest bout, prior to Monday, was pure luck. Or not.

Access to special insights and information below. What I like is the addition of the Endnotes, where I put my opinions, and refer to research and publications. I promise I’m not inventing stuff.