Start Where You Are

Making Money Overnight Was Easy, But Now We Are Back to the Red Arrow

About Last Night: 2024 Election

Here’s what academic economists said.

For the working class, “slowing inflation” doesn’t mean too much. Just because the box of Cheerios didn’t rise by 10% is unimportant, when the price is still $6/box. I responded on “X,” you can follow me by pressing here.1

Did We Need That Description? Probably Not

If anyone knew this in advance, then the outcome would’ve been obvious. Like most things, elections are a strategy exercise. If you win the largest demographic groups in the largest states, you win. The end.

In hindsight, the Vice President clearly failed, there was no excuse for not knowing how important the fastest growing voting bloc, Latinos, is. These figures are nothing short of staggering.

Let The Monday Morning Quarterbacking Begin

How to spot a liar (strong word, it is suitable here)

If you know anything with 100% certainty, then you don’t need a diversified anything. You are wealthy by dinnertime, today. Simply, you borrow as much as you can from banks or whoever/whatever you know, add that to everything you privately have, there will definitely be a place where you can get the most return. You pay back what you have borrowed within a day. Voila.

Therefore, when you hear “I knew [whatever event] would happen” = pants on fire.

Let’s try this instead

GIVEN “X,” then we highly suspect that “Y” will be the result. So, X = President Trump wins, then Y = Crypto and stocks higher, bonds lower (more on that aspect), in the short run. The market did exactly this. To what degree is completely unpredictable because we have no idea “who already has these positions, and in what amounts.” No one is sending out a memo to the world to reveal this. All you can do is observe, no individual investor can ever know this.

Can Wall Street know? Ultimately no, but it will have many, many more datapoints to estimate this because the largest pools of capital are talking to Wall Street around the clock. Pool #1 may have a particularly setup, Pool #2 has a slightly different one, and so on. Wall Street does know, in part. Are they sharing of this with Acme Wealth Management? Nope. If Acme Wealth Management is telling you that they do know? Re-read the first section of this article.

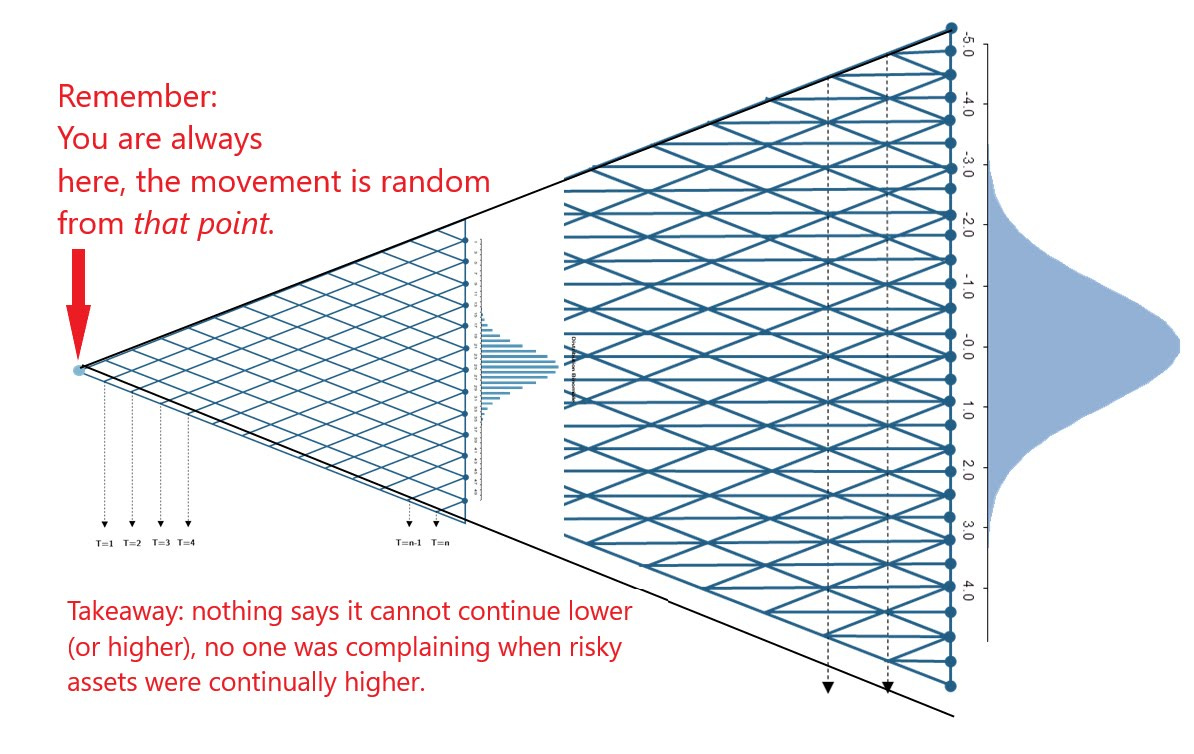

Now what? Start Where You Are

To followers, this graphic is not new. You could’ve used it last night. It works again now. It will work tomorrow.

Asset Class Relationships Are Out Of Whack

I don’t care too much about absolute direction. I could be right, I could be wrong, I could change my mind a 1000 times in an hour. However, in explaining financial planning to every age division, I care A LOT about the relationships amongst asset classes. The reason is that since the absolute direction is random in the short run, there are other “inputs” to how portfolios are built, which all of the largest diversified portfolios on the planet use, as a reference.2

Since asset allocation is the greatest determinant of investment strategy returns, from a practical point of view, this principle demands attention. This is especially true when there are events that introduce great volatility, and yesterday qualifies.

Given all of that, the following observations as of this writing (8AM ET).

International stocks down (tickers FEZ and EEM). The theory of allocating to international stocks [and bonds] has always made sense, the practice hasn’t made sense for more than a decade, unless you wanted to try to ‘buy dips and sell rips.’ Good luck to you on that. The market “might” be telling us that trade wars etc are en route, can very easily be wrong, that would be the backfit logic.

Small caps are more than 3x better than Nasdaq. HMMM. The idea “likely” is that the incoming president will favor US-based companies, as protectionism (tariffs) and US corporate tax breaks become more probable. International companies will not have this luxury, Apple faces its fine in the EU, this was announced yesterday.3

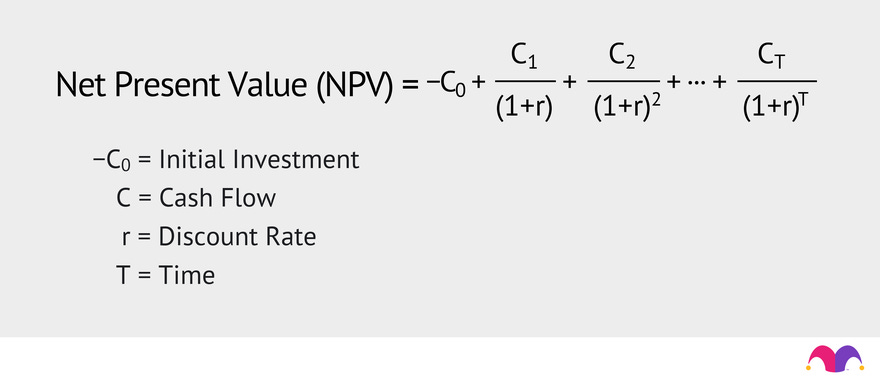

Interest rates spike higher. The idea here is that the proposed policies will greatly increase the US debt.4 The problem with that idea is that there is a counterpoint, which I have made in many live broadcasts in the past. Jae’s Rib Shack is more sensitive to interest rate changes than Apple Computer or Meta. Jae’s Rib Shack is a small companies, borrows money to fund whatever. High interest rates increase costs. A wealthy person is less sensitive to higher credit card interest rates than the person that lives check to check. The NPV of Jae’s Rib Shack can swing around with more uncertainty if interest rates (r) are higher. Another oldie but goodie.

So while the idea of US-only companies doing better than ones with internationally-based revenues, the counter-argument runs against this. Net result: my squinting is here. It might be temporary, it might not.

Interest rates and foreign exchange vs Crypto. So President-elect Trump is the self-proclaimed “Crypto President,” that’s fine. The issue for investors is that it provides diversification, also fine. One of the rationales is that the returns will be uncorrelated. Hold on a sec. That was fine when interest rates were zero, and the dollar was weaker (gold is denominated in US dollars). Again, friction exists, requires some thought.

US Dollar higher. Ugh. It’s fine if you are travelling overseas, your US dollars go further. It is not fine if you have to compete with European companies (like Volkswagen or Bayer AG) in commodity products. The US Dollar strengthened by almost 3% overnight, a gargantuan move, far larger than any other point here. I would mention one more, which is related to this point, better left for another day.5

The important footnotes and commentary are for subscribers to give further background and insight.