When Will The Volatility Stop?

The VIX tells you: not today (probably).

The professional market keeps an eye out on a statistic call the VIX, and instead of the textbook definition (link), let’s describe it this way.

There are options on the S&P500 as a whole, which benefit or lose if the S&P500 rises or falls. The payout diagram of a call option looks like this, this hockey stick-shaped diagram is VERY FREQUENTLY shown here on this Substack.

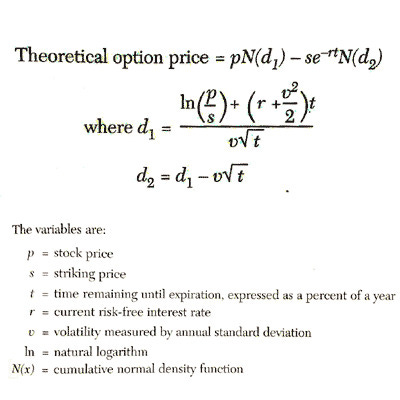

There is a formula for this, a single one. Again, not new, I have pasted it here often to show you the payoffs (benefits) when you buy insurance. A stock itself is a call option on the value of a company, where it only gains value after it can pay its bills/financial obligations. Back to the point: the point here is that there is a known, publicly-available market for these options. You do not need to be able to calculate this by hand, the intuition and explanation of the different factors are more important, because they can be adapted so that you can understand the widest range of financial topics.

The VIX is the SOLVED ANSWER, by taking the known price, and putting it into that formula (roughly), and solving for the letter v in the formula. If I gave you the equation A + B = C, and you knew C and B, you could figure out A. That is the solved answer, much like the VIX is the solved answer from a notably more-complicated equation.

The VIX is informative because it can give you an idea of what the professional market believes to the range of prices you could see within a time period (day, week, month, year, etc). What I “think” doesn’t matter, we are just observing what prices are telling us.

Today the VIX is approximately 31%. If you translated that into the market’s expectation of how volatile the S&P500 would be today, then it is roughly equal to 31% x (S&P500 futures level, now 4314) / square root of t (square root of 365.25, 1 day), you get = 67.71. This means that even if you have no opinion, the professional market is telling you that it expects the market to move 67.71 points in some direction today. 67.14 / 4314 = 1.55% a day.

Not coincidentally, frequent readers of this email have known that I have pointed this out, that the VIX was stubbornly high, even when financial markets may have looked “calm” from the surface.

That all said, these are predictive numbers, that doesn’t mean that it will actually occur, when all is said and done.

And while you were sleeping, overnight, the S&P500 has already travelled the 67 points from high to low. Money never sleeps indeed.

Mixing Facts With Opinion

AHIP is a trade association, the members are insurance companies. Or course, they are promoting Medicare Advantage. To bluntly call something “better,” however, needs to be examined, rather than to be accepted as fact.

Fact:

Providing Better Financial Security. Every Medicare Advantage has an out-of-pocket limit, and if you reach it, your costs are $0 for healthcare services. So yes, this is definitely true when compared to original Medicare, which has no out-of-pocket maximum limit.

Popular & Growing. No doubt, something that I have stated about 1 trillion times. 50% market share is almost a certainty.

Hmm:

Reducing Costs for Taxpayers. Unclear, despite the quotation cited.

Promoting Health & Peace of Mind. That is pretty aggressive. The additional benefits, screenings, surveys likely contribute to promoting your health, sure, let’s give them that. But, another motivation is to reduce claims paid by the carrier. And make no mistake: the #1 task of an insurance company is to make sure that its projections of costs are largely correct, and that the variance of errors is low. To the degree that this works hand-in-hand with “promoting health & peace of mind?”

Deliver Better Services. It’s not a question of whether or not certain Medicare Advantage plans have included these additional services, that is indisputable. But to call it “better” is too strong. Readers here know that this is the wrong place to find out definitively what is “best.” That will entirely depend on the individual situation. There are many instances where the nature of Medicare Advantage is inherently inferior and no matter what carriers do, they cannot remove those inherent differences.

Payments Equivalent to Original Medicare. “Medicare Advantage delivers more benefits and better value than original Medicare.” So if I received 10 extra benefits with a financial value of $0.1, but where it is weak or where there will be ongoing controversies (prior authorizations, for example), and it costs me an extra $100, is that better? This will again be on a case-by-case basis, not for overall, definitive-looking conclusions. To state it is “better?” Maybe, or not.

Bottom line: be careful when seeing pictorials with bullet points, even if the author is qualified (this party is qualified). Admittedly you can ‘say’ the same thing about me, which is why I have to repeat myself and why the list of topics is long, it’s that way so you can ask yourself what the likelihood is that the message is the same across this variety of topics? That is left to you.

Close Look At Medigap

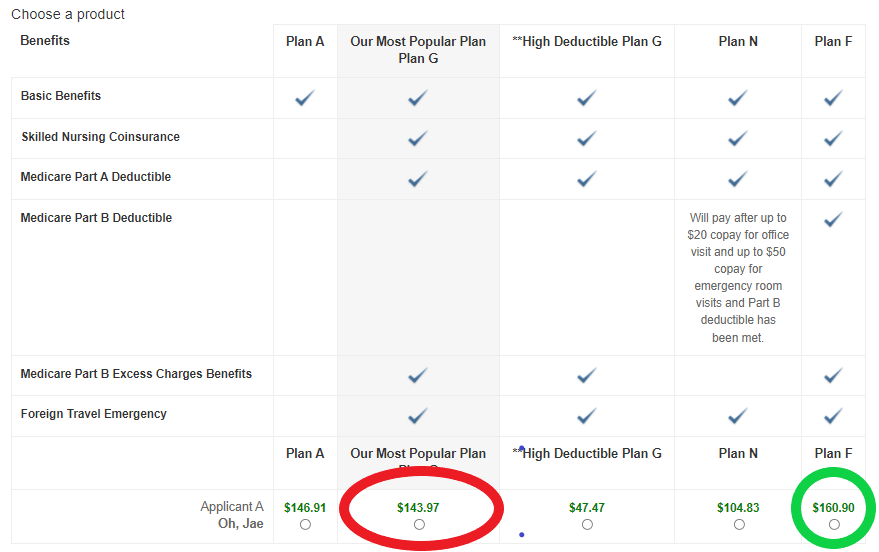

Do You See What I See? Plan F vs Plan G. Unnamed location, 70 years old. These are the rates for Medigap at a single carrier.

This is very, very instructive.