Off-Target

You'll Be Able To Buy Patio Furniture...Cheap

The Debate Over My Coffee Cup Continues

The Live Videos Have / Had A Reason (not financial advice, dyor)

For those that have watched the videos, and actually read the newsletter, it described auction theory (nerdy explanation here), the look at charts have everything to do with this theory.

Don’t forget to subscribe to Jae’s Corner on YouTube (click here).

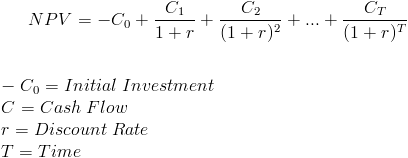

In easy language, I have described congestion zones. This goes back through earlier this year. There is a reason for the increased volume and increased attention to “What’s News” and “Financial Mindset,” which is that the world is full of attention to stocks and the numerator in the formula at the bottom of this article. This is fundamentally mis-placed because it is institutionally ingrained by Joe Broker. Summarized by? You got it: Stocks For Show, Bonds For Dough.

It gets worse, because those that concentrate on “ooooh, earnings are going to grow X% a year” should be “the market will pay ZZZZ for stocks, in the context of expected returns of asset classes around the world, in this environment, and this specific stock can command a premium or discount to ZZZZ.” AND THEN, it can still vary around that. The fact that these steps are largely skipped should tell you what you need to know. It is not as if I am the only person on the planet that knows this, duh. These skipped steps do not reveal themselves when the much larger asset classes (bonds and foreign exchange) are stable.

Back To The Auction (The Price Of My Coffee Cup)

Look at the thinnest line; if you think this is a coincidence, you could not be more wrong. This is how the algorithms work, this is what those that determine the short-term prices are scrutinizing, around the clock. So while the market isn’t open in the US, global markets don’t close.

The Next Congestion Zones Are Much Much Lower

The people that do this for a living, 24/7, will be looking much lower if this specific congestion zone is resolved lower.

Never A Sure Thing

The reason I have to continue to repeat? It is ingrained that someone will talk for 20 minutes about how “growth stocks have already been sold enough,” or “at 25% lower, WMT/TGT are buys,” etc.

Off Target

Target and WalMart have lost more that 25% of their market values over the past 2 trading sessions.

So r (the denominator) is higher, and if you look at r, it’s not well-explained. It should that r = risk free rate PLUS idiosyncratic adjustment (Jae’s Rib Shack cannot borrow at the same rate as JP Morgan).

So r is ignored (until it isn’t, as in now, to some degree), and two of the inputs are inflation and inflation expectations. The feedback look is to the numerator, a point made in certain videos.

Vanguard Targeted Retirement Fund

This is their version of the 2040 Targeted Retirement Fund (ticker VFORX). The best and the biggest diversified portfolio managers in the world are down.

Speaking Of Skipped Steps

The brokerage/advisory complex is highly motivated for you to NOT think about these. If these are in place, then you are far less worried today, because the layers of possible income are “thicker,” which translates into superior ability to deal with the current market conditions.