Network Problems and Hypocrisy

Inedible Combinations o Ingredients Persist

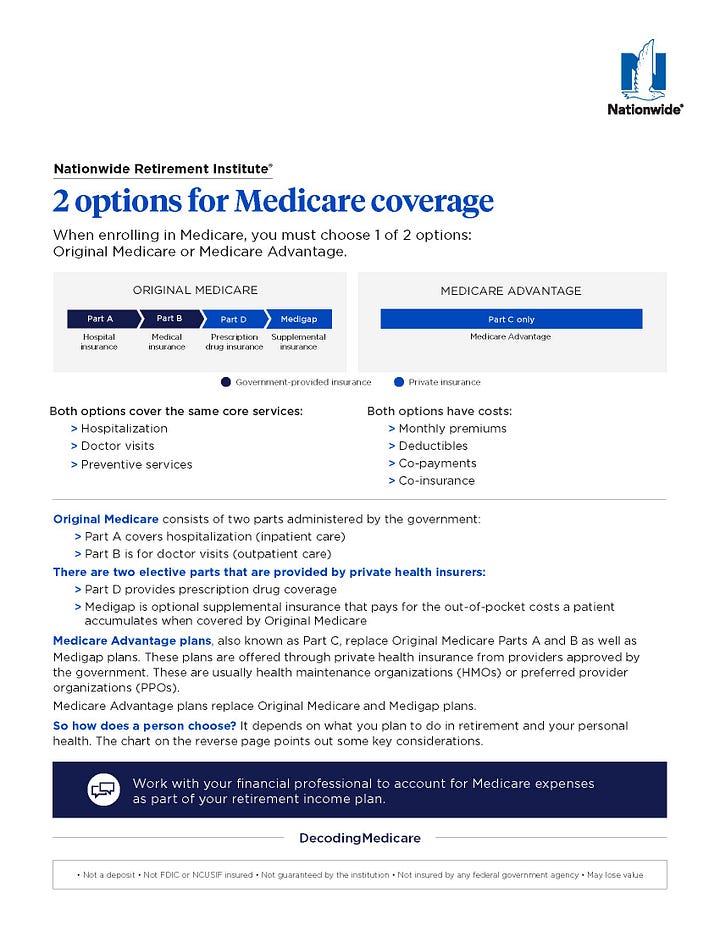

Nationwide Is[n’t] On Your Side

You must be kidding me, that this is how insurance carriers themselves explain Medicare??? I see Peyton Manning 20 times a day, he tells me that Nationwide is involved in long-term care, life insurance, and financial everything. Medigap received two sentences here. Well, at least my job is safe, so there’s that.

Their illusion of easy and simplistic is here.

OR here is how to get free Medicare guidance from us.

.

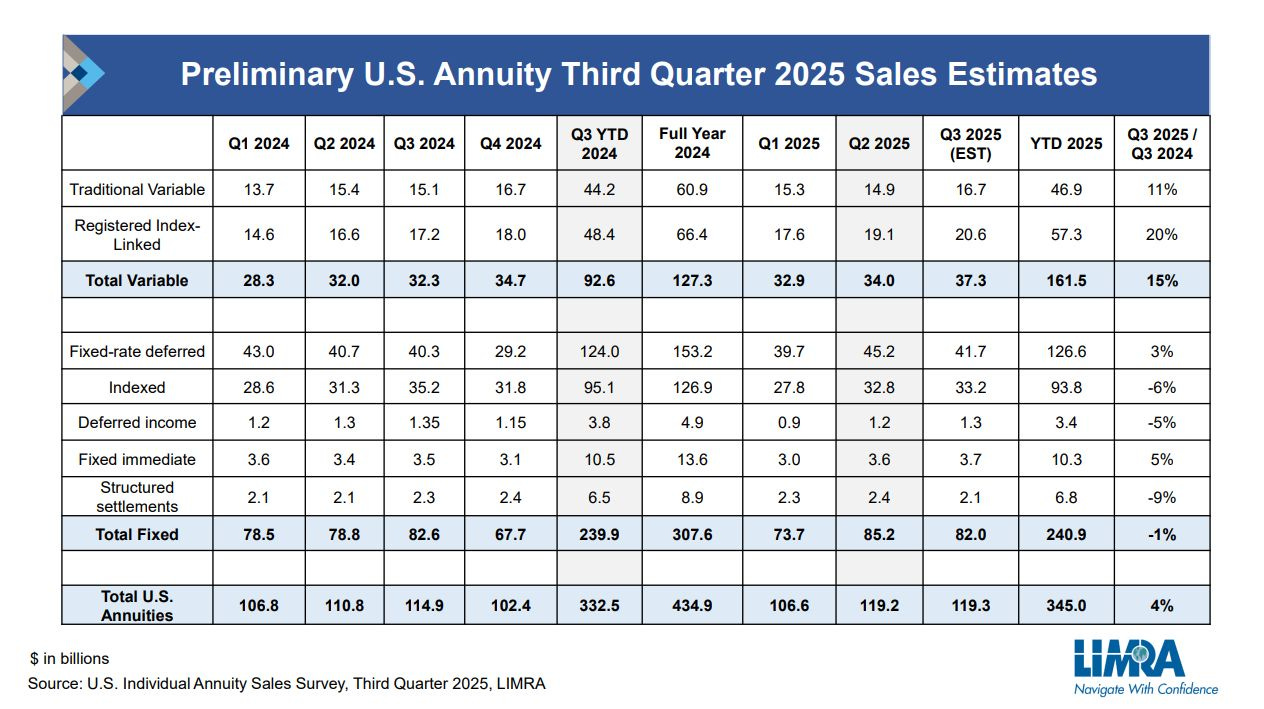

Annuity Sales Remain on Fire

I wish that I could say that the Alliance for Lifetime Income by LIMRA (I am an Education Fellow) was solely responsible. The function of guaranteed lifetime income is in high demand. That said, I am not sure if consumers and brokers fully know what they are selling.

The idea that annuities are being sold for “growth” is odd to me. If it is pure growth, and accompanying risk, that you seek, annuities are inefficient for this.

If you want to turn a pot of money into guaranteed income today, this is best, and clear. You can mimic Social Security’s “joint and survivor” pattern, for married couples. Simplified: “second to die.” If you want inflation protection, it’s possible, but too costly, in my opinion. When you add bells and whistles, the more you add, the more you can be slightly overcharged for the bell or whistle. Your consumer opinion can override my observations here, no problem. I take orders.

Fixed rate deferred and deferred income. Yes. Here is a clear beat by the annuity companies. The rate is higher, the income isn’t subject to tax until you have taken the income into your checking account. Private investors cannot access professional pricing of the bond market, not even close. Oh, and bond mutual funds are NOT the same thing as a fixed rate annuity. Competitive? I can find ties on the rates.

Deferred income “kickers.” I interviewed the CEO of Waterlily.com about long-term care and her AI-assisted tool. Long-term care is the obvious hole in Medicare, there is no strategy forthcoming. Some annuities have the ability to generate a future stream of lifetime income, if you don’t want to begin that now. In addition, the guaranteed income can be increased if you cannot fulfill 2 activities of daily living. It’s valuable, it doesn’t require underwriting.

I Am Not An Aggressive or Even Competent Marketer

You should definitely ask me about whether this works for your situation.

Risky markets have exceeded expectations, now is a good time to convert.

The market rates of annuities may have peaked, for primary and secondary reasons (it will take 2 hours at least to explain on video).

If you have an existing annuity, it is likely that you can transfer to an annuity that will outperform the existing (one-time fee analysis is available).

I still have concerns over the explanation that consumers are receiving about annuities and the “features.” It is not clear to me that you cannot re-construct minestrone soup when it comes to variable annuities. So while Ken Fisher is wrong by criticizing the ENTIRE annuity world, I didn’t say that there aren’t specific elements of truth. It depends on your objective and priorities, in an order that you determine, not me. And certainly not Fisher Investments or Acme Wealth Management. Yours, and yours alone.

Networks vs Insurance Carriers: Controversy Mixed With Irony

This example exists in countless locations. It happens to exist in Michigan, where a large hospital system is having disagreements with the nation’s largest carrier, UnitedHealth Group.

Corewell’s side of the story is here.

Let’s say they were correct. The explanation is laced with heaps of irony and hypocrisy. My video is for subscribers, because it doesn’t take away from the first mission: reduce confusion and replace it with facts and analysis. Underneath the surface, though, there is the message that stakeholders are attempting to leave with the unknowing public.