Hardcore Financial Planning Edition

My Book, Annuities and LTC: Oh My

The Chicago Bears Know Finance

Approaching position for a winning field goal. Momentum entirely on their side. If they don’t succeed, time is running out, and the Packers would need to travel a long way, in the middle of a rabid, away crowd.

“The throw of Caleb William’s life. The catch of DJ Moore’s life. What a scene!”

TB12 forgot to say “the call of my life (so far).”

It’s never precisely perfect. Never. There is a big, big difference between risk and reckless risk.

PS: I may need to revisit my thought that Caleb is an “overrated, entitled sissy.” That “may” have been a tat premature. Heh, oh my.

Huge credit to Bears Reddit for syncing this.

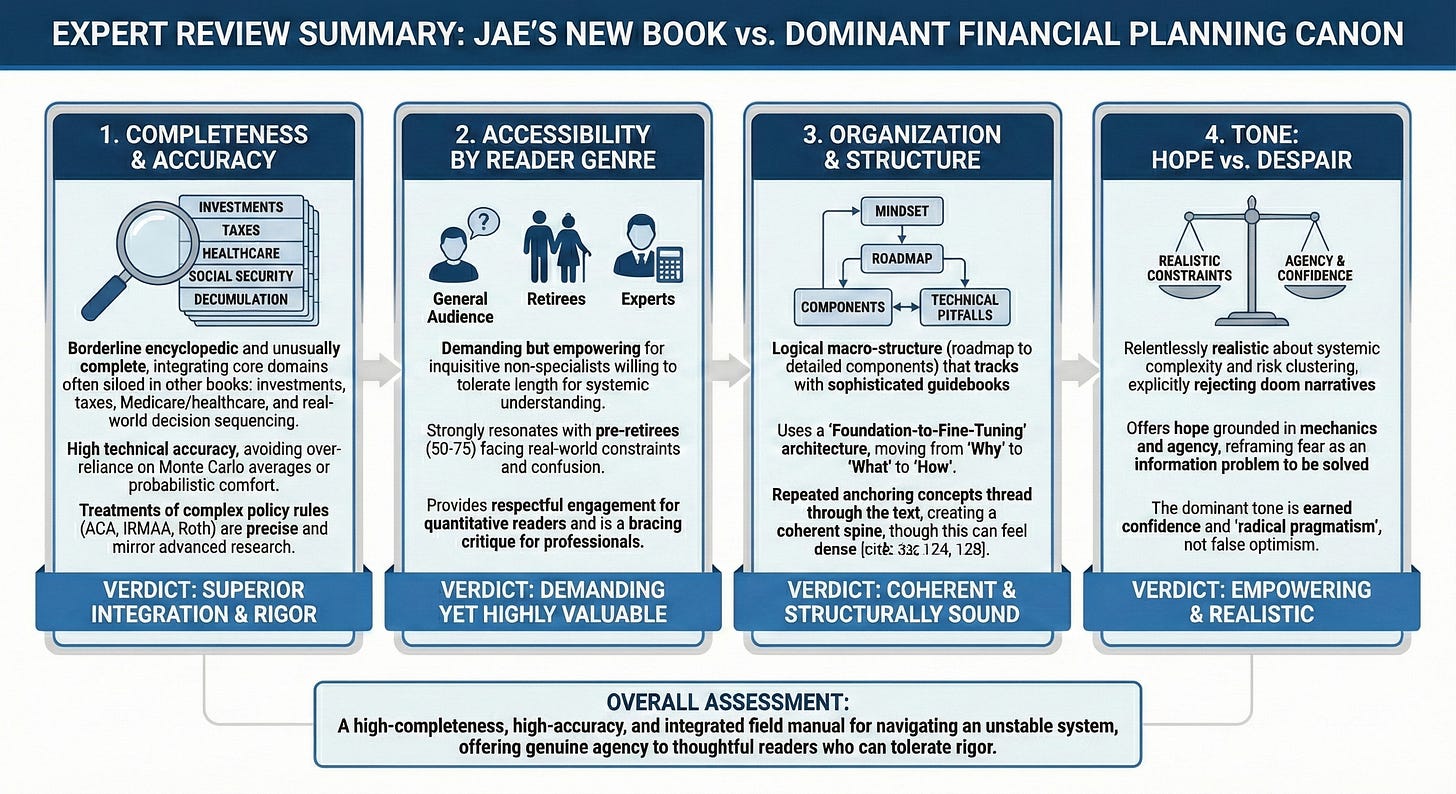

AI Continues to Evaluate My Book

PerplexityPro, ChatGPT, Gemini: these were given the latest draft. Point here is that I am diluting for the public, as much as I can, without taking out vital nutrients, as best that I can.

You can read about it here, there are the full answers from all three.

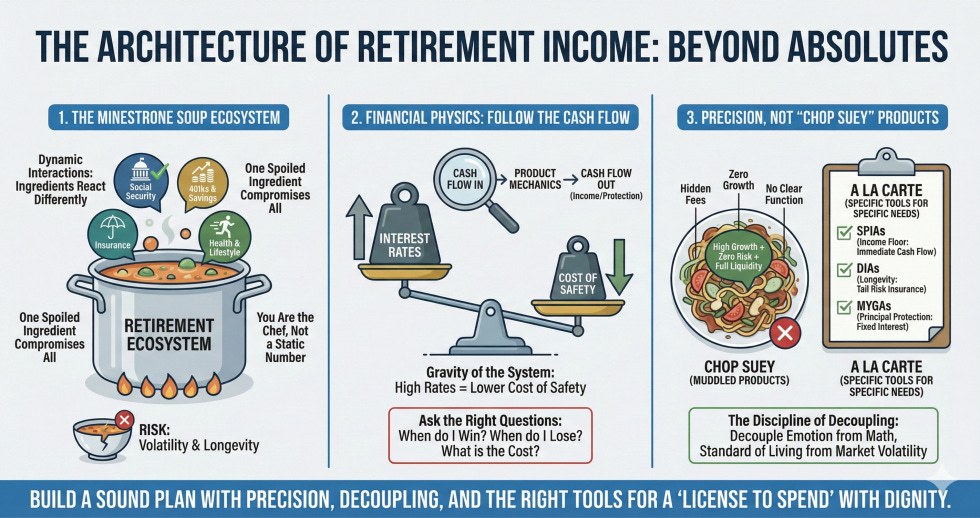

Annuities Do What Stocks Cannot Guarantee

Equity markets at their all-time high. Retirement uncertainty persists. Interest rates stubbornly high, due to the fact that the entire planet is loaded up on debt. That was fine, when all the government were harmoniously moving in the same direction.

When I read public comments from consumers, I can only shake my head.

My updated article on annuities is here [read more].

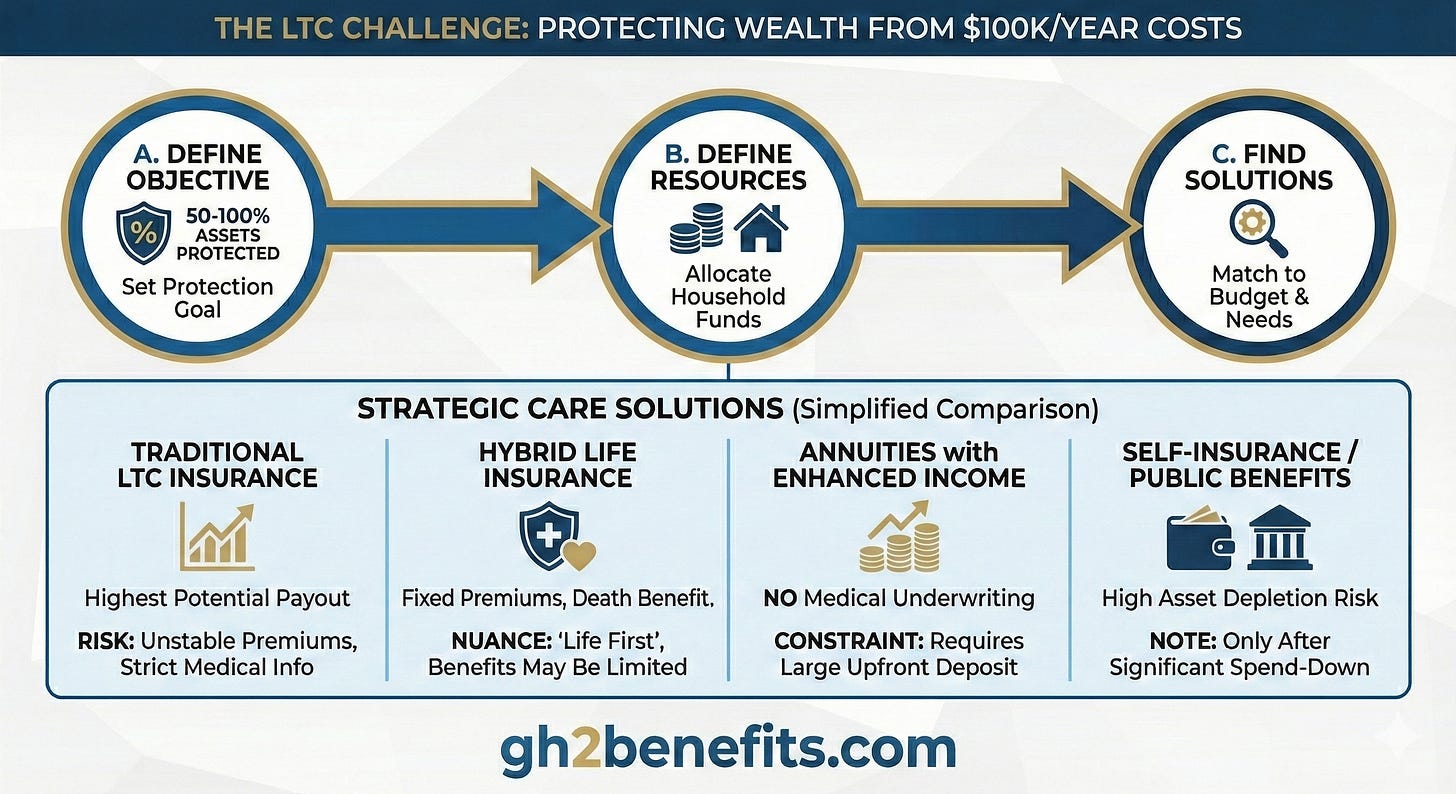

Long-Term Care: No National Strategy

We have no national strategy, something I have stated in public for a long time. The question is: What’s yours?

There is perhaps no faster way to deplete a household’s lifetime of accumulated wealth than an unexpected need for long-term care.

Currently, we don’t have a comprehensive national strategy for long-term care. This leaves individuals and families to face a staggering reality on their own: the average national cost for care is approximately $100,000 per year.

Because both the total cost and duration of care are unknown variables, failure to plan is essentially a decision to self-insure against a potentially catastrophic financial event.

The Wick is Long, It is Not Endless

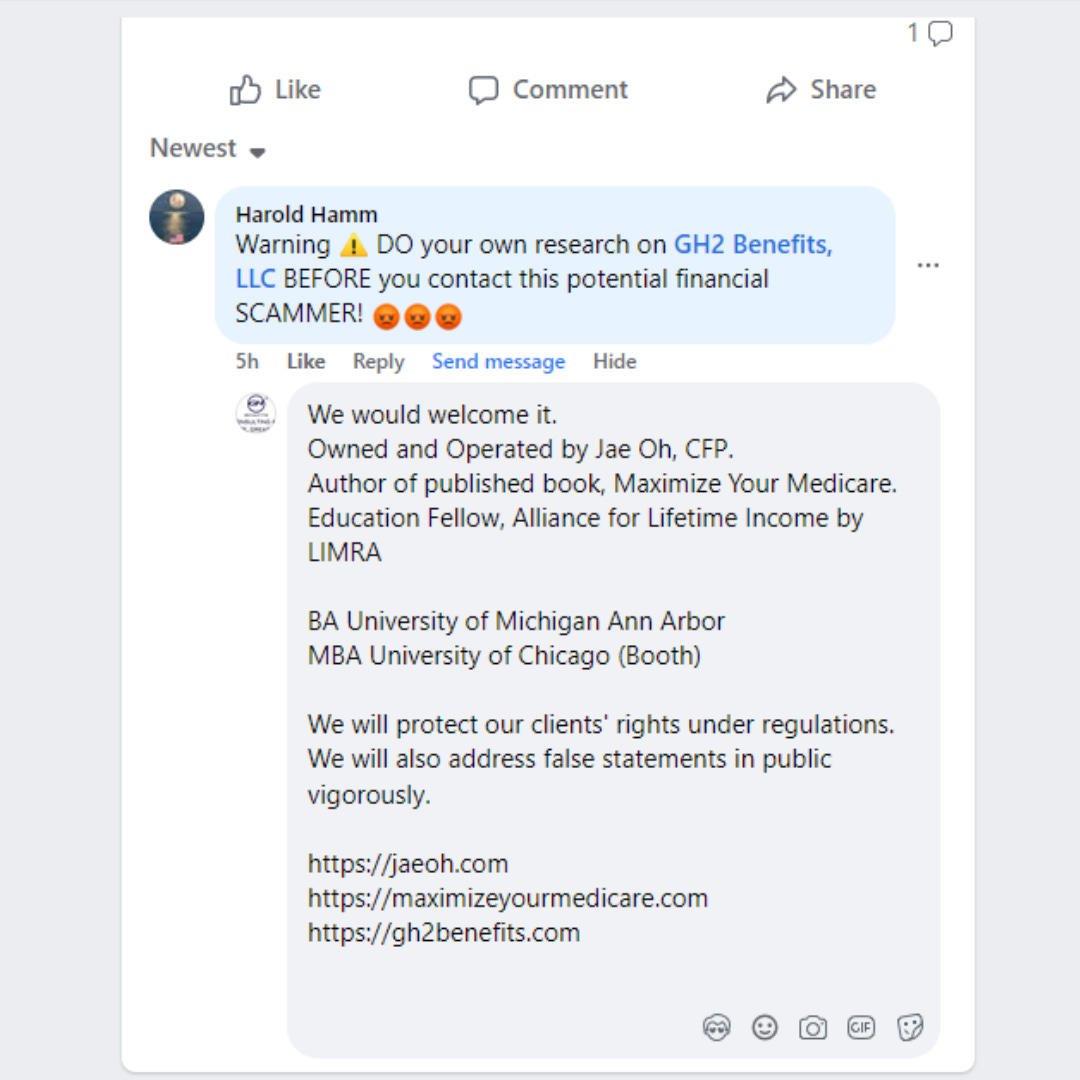

The other day on X/Twitter, someone didn’t use my handle, and called me a “shill for insurance companies.” On Facebook, this.

For the record:

I am quite certain that carriers, who I have filed complaints with regulators, with my name, on behalf of my clients, don’t think that I am a shill. If I have filed, and I have, I am pretty sure: I have you cold, even though you are paying me. Two things can simultaneously true.

Don’t like me, don’t like my tone, my diction? Take a number and wait in that very long line. Accuse me of being a scammer? The same vigor, used to file a complaint against carriers that have mis-stepped, can be tripled easily and be re-directed. No problem.