Finance Basics: It's A Duck

It's a bird, it's a plane, nah, it's just a duck. And we know how to calculate the price of a duck.

Insurance: A Picture Is Worth A Thousand Words

If it looks like a duck, and quacks like a duck, it’s a duck. Let’s not call it an elephant.

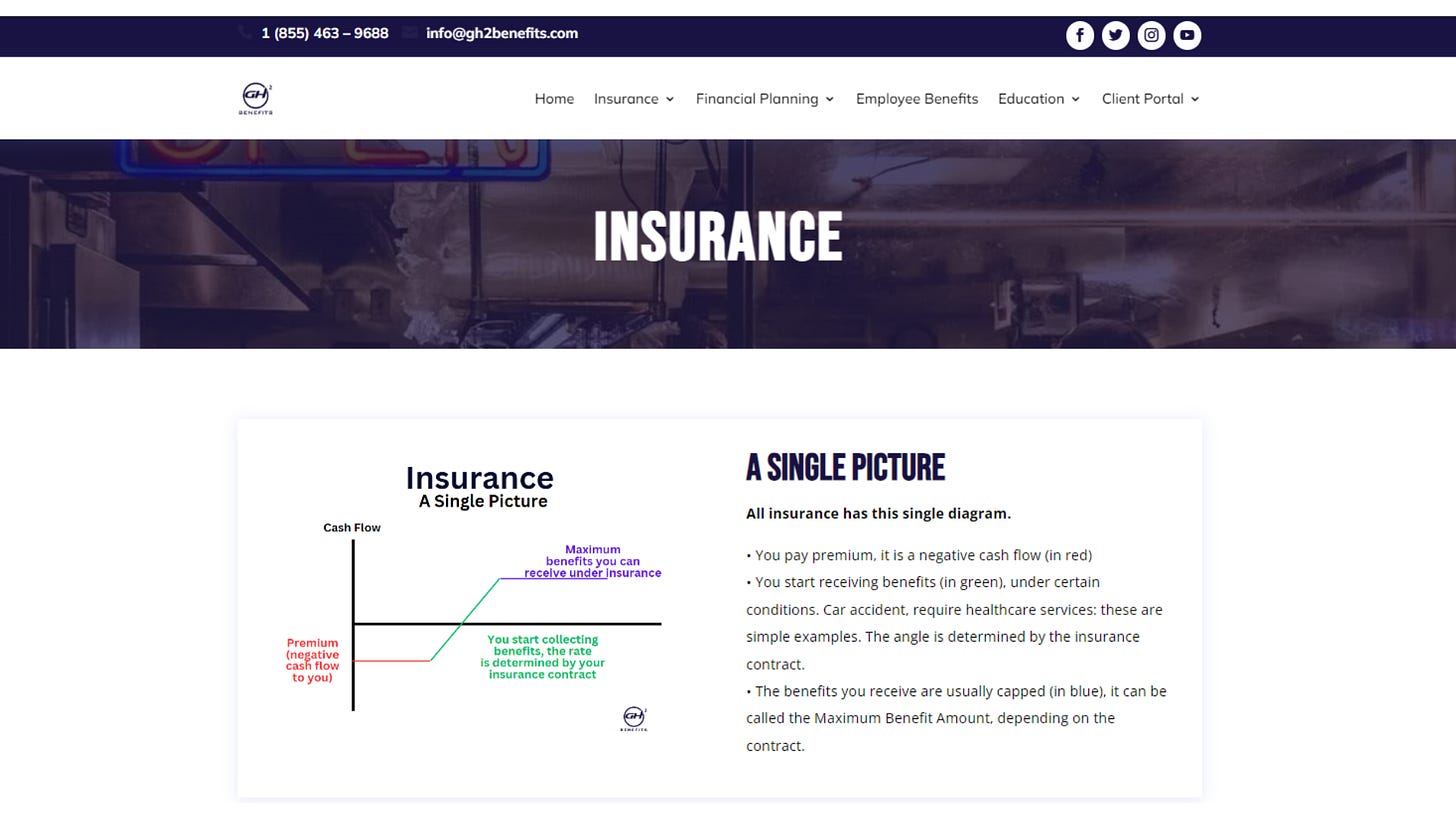

Most Insurance and most other financial contracts, that involve uncertainty, has this single cash flow graph (you can and should see the full webpage by clicking here).

You pay premium (the red line, it’s negative cash flow, since you are the payor).

If something occurs, then you collect benefits (i.e. you don’t pay the full cost). The “something” is if you get in a car accident, if your refrigerator stops working. That’s the green line. The ‘angle’ is determined by the financial contract (dental insurance, auto insurance, annuity, whatever).

Benefits are capped at a specified level. You don’t get benefits in infinite amounts, the benefit amount is capped (you don’t get $1,000,000 if you total your 2010 Chevrolet Impala).

Long-term care insurance has a Maximum Benefit Amount. The structural problem with long-term care insurance is that the carriers can change the premium (the cost of the red line). And you have limited flexibility to change it under those circumstances.

Dental insurance has a Maximum Benefit Amount.

Auto insurance, homeowner’s insurance, extended warranty on your oven: yep, all have a maximum payout amount.

Health Insurance (ACA) and Medicare with Medigap and Medicare Advantage have NO maximum benefit amount: now you know why health insurance is more expensive and why it is more valuable: the cash flow diagram is uncapped if you own health insurance. You get unlimited benefits if that is what the situation requires.

The Complicated Language Isn’t Complicated

The terminology of finance is simply to describe the conditions under which the red, green and blue lines apply. The shortcut I have taken in the diagram, in order for it to be more clear for you, is that the red line goes lower, because you are responsible for the deductible, copays, and coinsurance.

Oh Wait, Lookit

If you look inside an Options Strategies For Dummies book, then, you will see the diagram below.

To which: “If it walks like a duck, and quacks like a duck, it’s a duck.”

Insurance = a collar, which is a combination of two hockey stick graphs.

Our Job Is Both Easy and Hard

It’s hard:

it is hard to get the population to stop from saying, “the insurance company is conspiring to screw me over, and not pay the benefits I am owed.” That makes no sense, the carriers can be closed if they are systematically doing this.

it is hard to keep people from thinking they are experts in the pricing of this diagram, like physicians who believe they should be setting health insurance market policy.

it is hard to explain that the auto insurance diagram is exactly the same as the long-term care insurance diagram.

it is hard to explain that the likelihood of you getting the green can vary, so the sellers (insurance companies) want to preserve the right to NOT sell this diagram to all applicants at the same price. You would do exactly the same thing if you were in their shoes.

It’s easy:

it is easy because once you have learned correctly, you will quickly understand that the logic applies to many topics.

it is easy because the world is so competitive, the red lines (price) are virtually ties, if you qualify for coverage. Then, all you need to do is correctly identify the objective that suits your situation.

By the way, two more things.

Options have one formula, called the Black-Scholes.

“Someone random dude’s” original profession? Options trader, yo.

Not too hard to flip around these diagrams, attach the jargon of contracts, and apply them to the price of a duck….

OR OR OR…I am makin’ it all up, outta thin air.

Outline Of My Second Book

Paid subscribers can laugh at me for my foolishness. You get:

Free copy of existing Maximize Your Medicare (I will pay for postage inside the lower 48 states).

Access to subscriber info on the website, where I have curated and opined about all sorts of financial stuff, so you don’t have to. And, you’re not qualified to critique, either, I might be.

Medicare ABCs webinar, Sept 28, days prior to the opening of the Medicare Annual Election Period.

Fool me once shame on you, fool me twice…