DOGE Will Affect You & Your Money

Almost everyone will be affected, one way or another. And, if not you directly, you will definitely know someone who will be (hint, tell them to subscribe to this newsletter for free, non-partisan information, I detest the way our political system functions, and have for a long time, it isn’t anything new).

We had a production / connection problem that I cannot resolve, the recording cannot be recovered.

This is the outline that I used. You can send specific questions via email to info@gh2benefits.com.

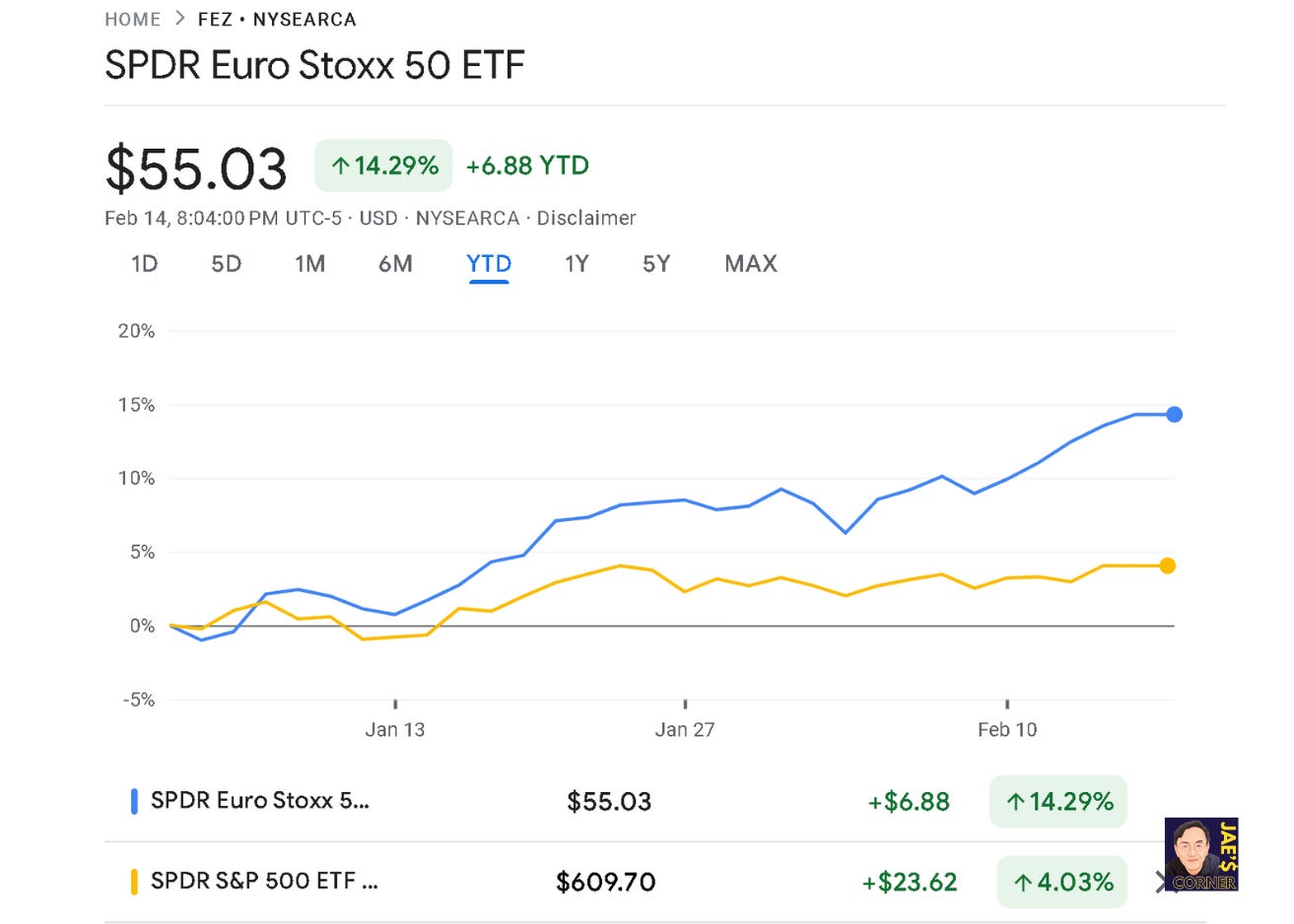

Markets Shrugging Off Commonly-Held Beliefs

Amid incessant headlines, which could possibly create financial and economic turmoil to someone, somewhere, Mr Market has, ultimately, shrugged. However, notably, there are biggies which are inexplicably negative for the year, given the market as a whole: Apple, Microsoft, and Google.

Here’s a short list.

Government employees (of course, this has been widely publicized). What you can do, what you should (and shouldn’t) do.

Health insurance via Marketplace (ACA)

Who’s Next (and why you should pay attention)

Savings & Investment Accounts (Markets update)

I will discuss these tomorrow on YouTube at 11AM ET.

Press the image, subscribe to the YouTube Channel here, and don’t forget the Notification Bell.

Tariff Talk: Bluffing Can Work For Now

Some may know this, I play poker in real life. Both in person, and online. I am better than average, nowhere close to a professional. Being a professional would take thousands of hours of study, that is time and interest that I do not have. An educated enthusiast is a good description of me.

The parallels (and misunderstanding) to financial anything are everywhere. People have a naming problem when it comes to poker, similar to the way that understanding of money has a naming problem.

Poker is:

First and foremost, poker is a technical, probability-based exercise (exactly as financial markets, insurance, and financial planning). Your home game with buddies is nothing like professional poker, unless they all understand the Nash Equilibrium.

Subject to randomness (exactly as markets), which is wrongly-equated with ability to predict the future, just like finance (“I knew it was coming,” “I was due,” the list of quotes is literally endless).

Affected by human emotion and judgmental error. In person, I am a far more difficult opponent than online, because people wrongly presume stuff that they shouldn’t, that provides the 3-5% edge required for me to win (usually). Shhhh, do not tell anyone, but I am intentionally cultivating this, and by the time they discover this, it can be just a step too late. Not always.

Wrongly-equated to gambling. Uncertainty itself is not the same thing as gambling. To call poker or the stock market or insurance to be the same thing as roulette is as WRONG AS COULD POSSIBLY BE. There is a reason that I am so

annoyingcareful with words. People have the wrong understanding, apply Occam’s Razor lazily, and then use that combination and apply it to other financial decision-making exercises. What could possibly go wrong? You mean…other than everything?

What Does This Have To Do With Tariffs?

Game theory. Look at the third point. Let’s presume that everyone has the equal knowledge of the outcomes, if they played out. I win $XXX, or I lose some other amount $ZZZZ under certain scenarios. I assume that you, my opponent also know how much outcomes affect them. That’s presumed already.

One way to get your desired outcome (make $XXX) is to bluff, and bluffing can work. You convince the opponent, the opponent caves to the pressure, you get the desired outcome ($XXX).

In real life, this comes with certain risks.

You need to be able to afford it, if this doesn’t work. For the US vs Canada/Mexico, this can work. They were low-hanging fruit here. There are multiple interdependencies, and the Canada/Mexico are economically weaker, for one reason or another. In that same vein, China and India are not the same thing at all. There is a reason that Jae’s Corner has incessantly continued to mention these two. They are many times larger in population, and the average education level is laughably higher than we in the US. To bluff against poor, smart, and hungry “isn’t great,” to put it mildly.

Bluffing needs to be credible, or you will look silly and amateurish. This explains how and why financial markets have shrugged off the headlines: financial markets have voted on the whether or not the threats of tariffs can be enacted.

See the past two points? They don’t match. The point is that IF you believe that tariffs can work, then you needed to have enact them, in order to maintain credibility, even if the immediate short-run outcome was negative, in order to achieve the ultimate outcome. If you do not, then you are risking that you will never get the ultimate outcome. That is a very high-risk approach, especially if the opponent has more chips (education, people, resources, friends) than you.

Caution is warranted. That doesn’t mean the outcome will be negative, but it does mean that the outcomes are more uncertain, the results varying more widely, than in the past, when poker didn’t involve bluffing.