Does the "4% Rule Work" In Practice?

Yesterday, at dinnertime, I attempted to create a livestream on our website [not YouTube], but it failed.

In this video:

The “4% Rule” is a guideline for withdrawing from retirement savings.

I examine the most qualified author on the topic [more or less], when it comes to qualified authors. But, even the best ignore a huge number of people, and that creates ripple effects. I discuss how this happens, and the issues it creates.

That health is not part of this paper is odd, to say the least. To say “we don’t know how long you will live” is true, but for some, you can reasonably estimate that you will live longer than average, and that affects everything.

The implication is that the public can get a misguided idea of how financial planning can and should work.

Financial Markets Update {starts about the 40 minute mark].

Suddenly, Markets Not Boring

After the video above, I thought it was going to be very uninteresting today, but Mr. Market smacked me across the forehead, and my radar turned up a notch.

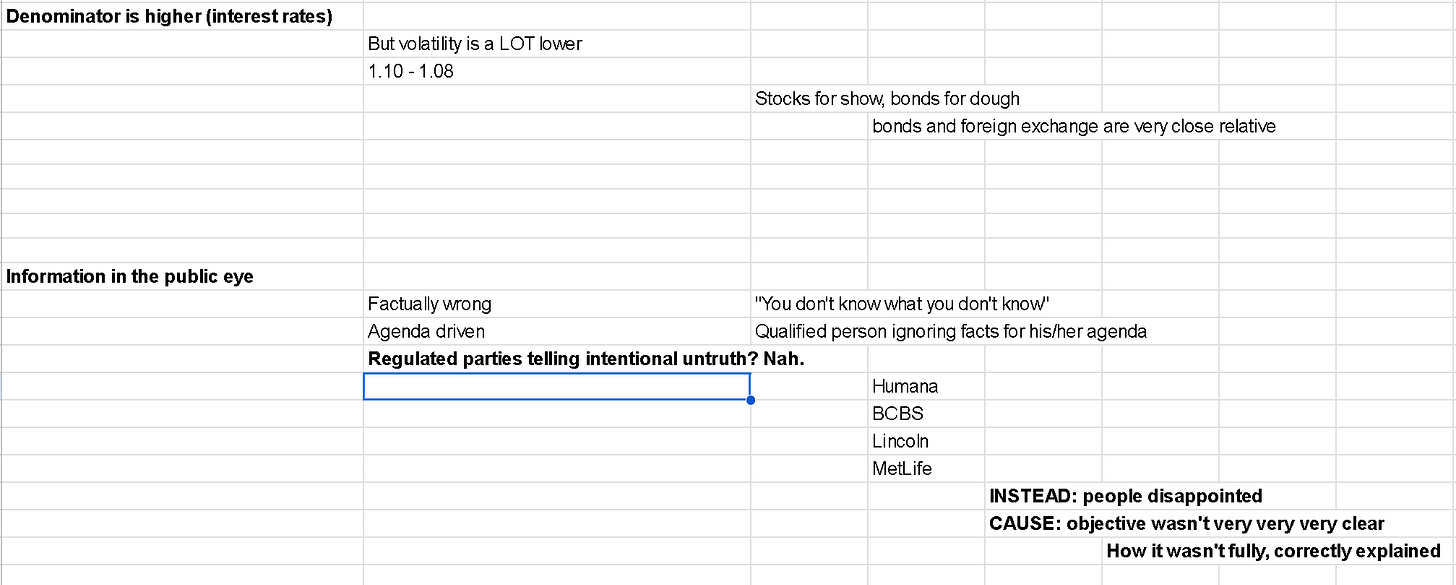

Stocks for show, bonds for dough, and for the first time all year, interest rates moved, and so did foreign exchange. Now, my radar is on, and I explain why.

If you want to torch all of your money, then simply ignore this image. If you do not want to lose lots of money, then understand that the parties and forces involved in “r” in the image below are infinitely larger and more important than those choosing how many shares of NVDA you should buy or the target price.

Today, equities ultimately aren’t moving much. But make no mistake, I’m paying attention much more closely now, because I am sure that those on the actual playing field are, too.